Everything You Need to Know About Apple Card Savings Account

Apple Card Savings Accounts are exclusively available to Apple Card users. To open one, you’ll need to sign up for an Apple Card first. Check out our guide on how to apply for an Apple Card for step-by-step instructions.

Once you have an Apple Card, here’s how to open a savings account:

- Open the Wallet app on your iPhone and tap your Apple Card.

- Select the three dots in the upper-right corner and tap Daily Cash.

- Scroll down and tap Apple Card Savings Account.

- The Wallet app will ask you to enter personal information like your SSN and agree to terms. Submit the application and Goldman Sachs will approve it.

- Setup usually takes a few minutes. Once approved, Daily Cash will automatically deposit to your savings account.

Key features and details of the Apple Card Savings Account:

- No fees: There are no monthly fees, overdraft fees, or minimum balance charges.

- High yield: Earns an APY of 4.15%, more than 10x the national average. Your balance automatically grows over time.

- Seamless spending: Easily transfer funds between your savings account and Apple Cash balance. Use Daily Cash on purchases with Apple Pay.

- Early access to funds: Deposits are available the next business day. Withdrawals are free at ATMs in the US and China.

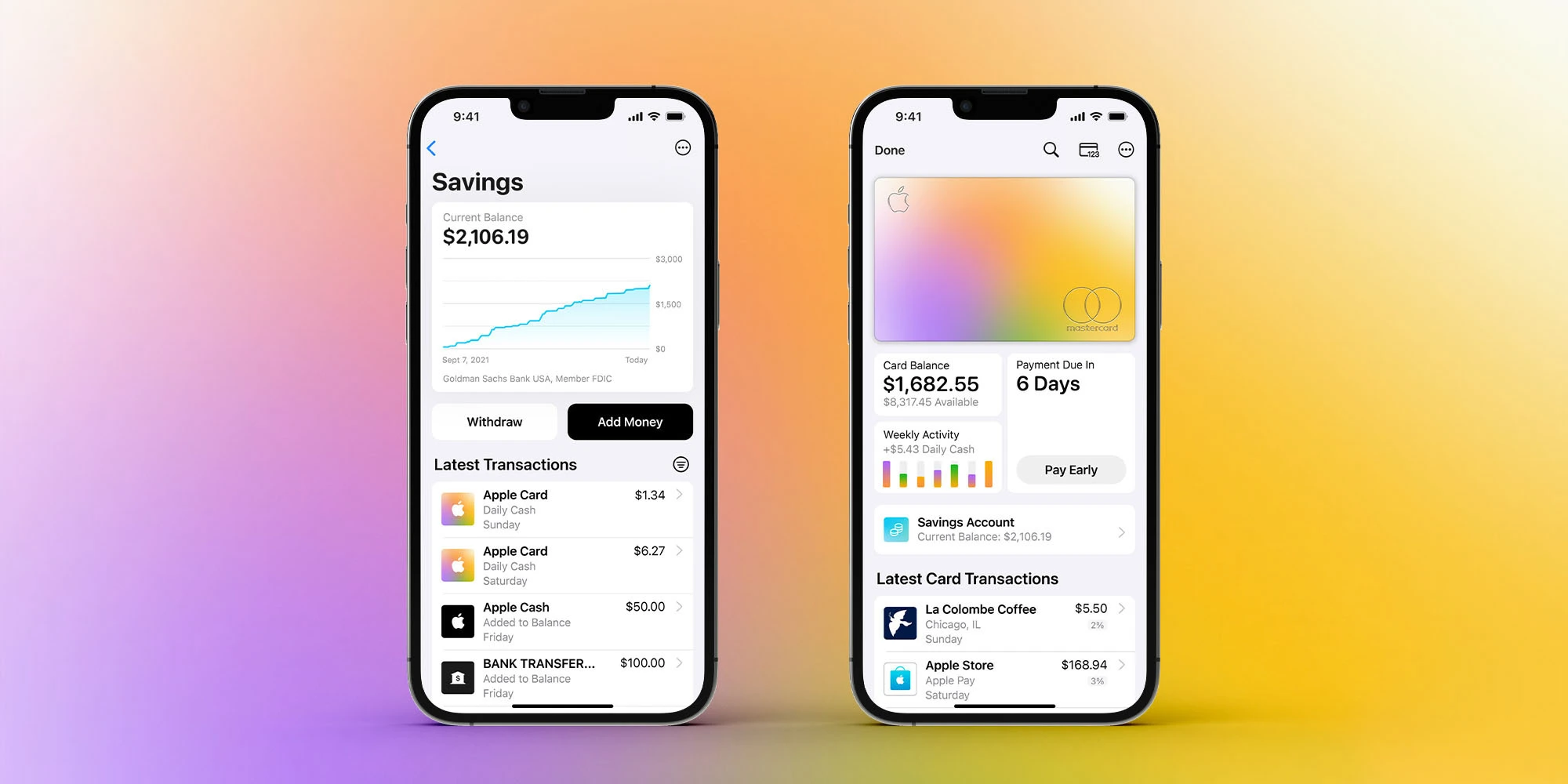

- Integrated with Apple Card: View your balance and transaction history right in the Wallet app along with other Apple Card details.

- No minimum balance: You can open an account with any amount and add or withdraw funds at any time.

How to access and manage your savings account Balance:

- Open the Wallet app on your iPhone and tap your Apple Card.

- Select Savings Account to see your balance, transaction history, and other details.

- Tap Add Money to deposit funds from a linked bank account. Tap Withdraw to withdraw money for free at US ATMs.

- You can also send money from your savings account balance to someone’s Apple Cash balance or bank account through Messages or the Pay app.